By Randy Arrington

LURAY, Oct. 13 — On Thursday morning, Valley Health System filed a lawsuit in Winchester Circuit Court against Anthem Blue Cross Blue Shield, now known as Elevance Health, for “egregious payment delays” in the reimbursement of more than $11.4 million for services rendered to its clients. The suit seeks total damages of $20 million.

“Anthem’s ultimate parent is a for-profit company with annual revenues of over $100 billion. It is more than able to meet the payment obligations that it agreed to with hospitals and doctors, including VHS,” reads a section of the civil suit. “These repeated payment failures constitute resources diverted away from VHS’s non-profit mission and the Shenandoah Valley community and into the pockets of corporate shareholders.”

The civil suit requests relief on two counts — one for breach of contract, and another for violation of Virginia’s Ethics and Fairness in Business Practices Act.

Valley Health employs almost 400 physicians and operates six hospitals, more than 70 medical practices and Urgent Care centers, outpatient rehabilitation and fitness, medical transport, long-term care and home health for patients spread across the northern Shenandoah Valley of Virginia, the Eastern Panhandle and Potomac Highlands of West Virginia, and western Maryland.

Anthem is the largest health insurance carrier in Virginia, controlling about 43 percent of the market. The insurance carrier partnered with Valley Health to provide medical services for Anthem customers. For the past two years, the healthcare provider has been working with Anthem to resolve issues with the reimbursement process.

“Anthem has left us no choice but to take legal action and expend resources to recoup the $11.4 million dollars in past due payments that are contractually owed to our health system, some of which are years past due,” said Valley Health President and CEO Mark Nantz.

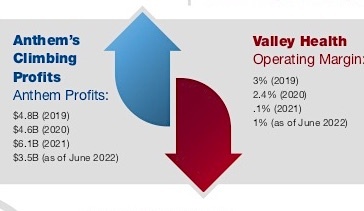

At a time when many healthcare systems are reporting record losses, Anthem is estimated to have cleared more than $6.1 billion in profits in 2021 — up 30 percent over 2020. By contrast, in 2020 alone, Valley Health provided $159 million in charitable care and contributions.

“We will continue to do our part to serve our community and ensure patients have access to the providers and services of our health system. But we must hold Anthem — one of the nation’s largest health insurers and responsible for a large portion of Valley Health’s revenue — accountable for the harmful effects of their payment delays that ultimately impact our ability to sustain quality community healthcare services,” Nantz explained. “We will not accept Anthem’s continued avoidance of the payments owed to our health system, which limits our resources to deliver the care our patients and their members pay for, expect, and deserve.”

The 12-page civil suit filed in Winchester on Thursday morning cites a multi-million dollar fine levied on Anthem by the Georgia Insurance Commissioner’s Office for “improper claims settlement practices and violations of the Georgia Prompt Pay Act. The Maine Insurance Department is conducting an “investigation and market conduct examination of the payment practices of Anthem’s Maine affiliate,” where Anthem reportedly “owes $70 million to a hospital system based in Portland, Maine.” According to the suit, “media reports in the past year have stated that Anthem owes more than $300 million in unpaid claims to VCU Health in Richmond.” In Indiana, Anthem’s affiliate was ordered by an arbitrator to “pay millions of dollars in damages to a group of Indiana hospitals that it failed to reimburse properly.”

The breach of contract claim cites agreements between Anthem and Valley Health and missing payments for services rendered dating back to 2019. That year, Valley Health reported $2.6 million in unpaid reimbursements. Two years later, that figure had grown to $9.5 million. In the current hospital agreement, the insurance carrier was obligated to “make payment for 95 percent of all Complete Claims for Covered Services submitted by the Facility within 45 days.” Under the agreement, Valley Health can not bill a patient for services covered by Anthem.

Part of the disruption in payments is being blamed on heated negotiations to renew a hospital agreement in late 2020, partially clouded and made more tense by the lack of reimbursement. With a new agreement in place at the start of 2021, Valley Health had hoped that “Anthem would turn its efforts to finally resolving the remaining claims disputes.”

“But Anthem’s claims processing failures only worsened,” the suit states, “despite regular meetings and phone calls. VHS often found itself in the frustrating position of answering an endless series of burdensome (and unnecessary) requests for additional information, none of which was apparently enough to satisfy Anthem.”

Valley Health sent a formal breach notice to Anthem on Aug. 31, 2021. Multiple failed attempts to resolve the issue and continuing delays by Anthem lead to Thursday’s filing in court. Valley Health has stated that patients covered under Anthem should not be impacted by the lawsuit and will continue to be treated at all of their facilities.

With initial complaints being formally lodged in March 2020, this week’s court filing has been a long time coming. On several occasions, the lawsuit juxtaposes Anthem’s record profits against the non-profit healthcare provider’s battle with “navigating decades-high inflation, pandemic-related financial challenges, and ongoing losses incurred from treating Medicare, Medicaid, and self-pay patients.”

•••

RELATED ARTICLES

Valley Health, Anthem announce new agreement

As COVID-19 acuity wanes, health systems face enduring challenges

$1.5 million from Opioid settlement, federal funds flowing into Page to combat substance abuse

Page Memorial’s $1 million USDA grant will help address rural health challenges

Valley Health names new Senior Vice President and Winchester Medical Center President

Valley Health’s acute care hospitals earn national recognition for patient safety

Valley Health says expanded testing ‘deal changer’ for handling pandemic

Be the first to comment